DJIA has posted a big long black candle last week.

never expect during the last few trading week we could have this type of market movement.

A new trading buddy AS, he has a breakthrough over this trading system, his trading system is able to tell whether we will have a breakout tonight or not.

combine with other 2 system he has, he has the target price, entry price, and either Long, or Short.

this is amazing...

but still, more is up! He is going to use Mathlab to program his system, mathlab - this application is for engineer to design and model.. what type of enthusiastic trader on earth could come out with this idea?

He said this is not new to professional traders, oh man, this is new to me.

Mad scientist - he is crazy, and he is the only one person i know one this land who is doing this everyday, and he is always hungry to learn thing, and to make his trading system complete.

clap clap to AS.

back back back to DJIA.

31 Dec 2012, last Monday in year 2012.

We have so many unanswered question over fiscal policy, tax increase and spending cuts, is US going to get over it? I am quite pessimistic, but I am also curious of what our creative US government and Federal Reserves could do about it.

Last Friday, DJIA has fall and close below EMA200.

From 4 hour chart, the inner wave has hit 3L.

Technical Analysis

Bearish sentiment could halt during Asian hour, and hopefully DJIA could retrace up to 12960 pts.

If market is suspended below 12960, and didn't breakup strong resistance 13080 pts, we might see market going south to hit 4L or even 5L target.

4L target = 12660 pts

5L target = 12500 pts

If there's good news, or any positive announcement from the lawmaker, market would swing up - anyhow it is going to be volatile.

Since I am pessimist, I will go short at any of these resistance level, preferable near strong resistance 13080 pts, it would then for another classic example of EMA50 in 4 Hour chart.

Fingers crossed.

Nasdaq 100

the Trend is bearish, market has break below strong support.

From weekly chart, this is what I forecast:

therefore, for daily trading, i would prefer short until market fall to 2500 pts.

Short at initial shadow around 2580 pts, SL 10 pts away, TG 30 pts (2550).

Sunday, December 30, 2012

DJIA and Nasdaq 100

2013 ……要来了

眼看ForexFactory都已经显示2013年的经济数据报告公布时间,2013年,近了。

明天将是2012年最后一个交易日,写到这里,我不禁感慨时间稍纵即逝。

舞者的经历

2012年我开了总共5班肚皮舞班,见证学生们从posture姿势,到hip drop,然后再慢慢地将舞蹈融入自己的身体。

时而我害怕,时而我感恩;

害怕很快我就不能够负荷他们的求知欲,

感恩有他们一路陪我成长,甚至成为我编舞的实践品。

Ayumi the Novice Trader 的经历

2012年我认真地学好Power Wave,认真地学好我会的技术分析。

而不是一味地追求不同的技术分析。

当然因为舞蹈和工作的关系,今年trading的时间减少了很多。

我让自己适应高time frame的分析,很意外地,我发现自己的表现平稳了,

因为冲动而盲目进场频率减少了。

打工一族的经历

由一间跨国的印度软件公司,小小的销售人员转到Business Consultant -- 也就是从销售的框框跳出来,投入软件的实践。主要工作便是Implementation —— 从公司的运作,到软件的调整,到加以实践。

由于受不了100%软件操作的工作模式,我加入另一家新加坡公司成为销售经理(也只是和衔头,别太在意),看清自己的兴趣及专长以后,我加入另一家更大的跨国公司担任软体预售顾问。

跳槽,本来就是一件很普通的事情。一年跳3家,简直就是我本人的记录。

接下来,就是努力实践我Dancer + Trader + Consultant的日子咯。

2013年我的resolution很简单,把手上的工作做好,以及避免踏入圈套。

明天将是2012年最后一个交易日,写到这里,我不禁感慨时间稍纵即逝。

舞者的经历

2012年我开了总共5班肚皮舞班,见证学生们从posture姿势,到hip drop,然后再慢慢地将舞蹈融入自己的身体。

时而我害怕,时而我感恩;

害怕很快我就不能够负荷他们的求知欲,

感恩有他们一路陪我成长,甚至成为我编舞的实践品。

Ayumi the Novice Trader 的经历

2012年我认真地学好Power Wave,认真地学好我会的技术分析。

而不是一味地追求不同的技术分析。

当然因为舞蹈和工作的关系,今年trading的时间减少了很多。

我让自己适应高time frame的分析,很意外地,我发现自己的表现平稳了,

因为冲动而盲目进场频率减少了。

打工一族的经历

由一间跨国的印度软件公司,小小的销售人员转到Business Consultant -- 也就是从销售的框框跳出来,投入软件的实践。主要工作便是Implementation —— 从公司的运作,到软件的调整,到加以实践。

由于受不了100%软件操作的工作模式,我加入另一家新加坡公司成为销售经理(也只是和衔头,别太在意),看清自己的兴趣及专长以后,我加入另一家更大的跨国公司担任软体预售顾问。

跳槽,本来就是一件很普通的事情。一年跳3家,简直就是我本人的记录。

接下来,就是努力实践我Dancer + Trader + Consultant的日子咯。

2013年我的resolution很简单,把手上的工作做好,以及避免踏入圈套。

Monday, December 24, 2012

DJIA and Nasdaq 100

for week starting 24-Dec-2012

Gold – being one of the few avenue for investor to store value is hovering near a 4 month low, are you going to hold on to the bearish gold, or hold on to USD which offer 0% interest, and infinite printing power?

Last Friday is a volatile day, market is moving down and up and currently surpressed below 13250 pts, support 13150 pts.

I reckon market to trade sideways between these two levels if no major news outbreak.

I am closing my book and not going to trade for the week and planning to enjoy my holiday.

Short trading week on Wall Street - market will be open for half day on Christmas eve, and off to observe Christmas day, resume regular trading on Wednesday but volume is expected to be light.

Cliff talk is still in the picture - tax hikes, and spending cuts decision will be moving the market.

Gold – being one of the few avenue for investor to store value is hovering near a 4 month low, are you going to hold on to the bearish gold, or hold on to USD which offer 0% interest, and infinite printing power?

Last Friday is a volatile day, market is moving down and up and currently surpressed below 13250 pts, support 13150 pts.

I reckon market to trade sideways between these two levels if no major news outbreak.

I am closing my book and not going to trade for the week and planning to enjoy my holiday.

Short trading week on Wall Street - market will be open for half day on Christmas eve, and off to observe Christmas day, resume regular trading on Wednesday but volume is expected to be light.

Cliff talk is still in the picture - tax hikes, and spending cuts decision will be moving the market.

Monday, December 17, 2012

DJIA and Nasdaq 100

for the week starting 17-Dec-12

Last 2 week of December 2012 were generally quiet for stocks, however, market could be volatile towards end of the week as we are still paying attention to fiscal cliff : increased tax rates, spending cuts in in January 2013 and expiration of options & futures contracts.

Technical forecast:

Weekly candle: Reversal candlestick pattern signal a bearish market.

Daily Chart: market has retraced 2/3 from October high to November low, with a bearish weekly candle and 3 black soldier, we could expect market to trade within 13,120 – 220 pts. before breaking down to target 13030 pts.

1 Hour chart: market has formed a butterfly pattern and hence we reckon market to be bullish on Monday Asian hour, and return to resistance 13,220 pts.

Hunt for short near 13,220 – 250 pts. and if market traded below 13120 it confirms the bearish sentiment, shift stop loss to entry and set target exit near 13,030 pts.

Last 2 week of December 2012 were generally quiet for stocks, however, market could be volatile towards end of the week as we are still paying attention to fiscal cliff : increased tax rates, spending cuts in in January 2013 and expiration of options & futures contracts.

Technical forecast:

Weekly candle: Reversal candlestick pattern signal a bearish market.

Daily Chart: market has retraced 2/3 from October high to November low, with a bearish weekly candle and 3 black soldier, we could expect market to trade within 13,120 – 220 pts. before breaking down to target 13030 pts.

1 Hour chart: market has formed a butterfly pattern and hence we reckon market to be bullish on Monday Asian hour, and return to resistance 13,220 pts.

Hunt for short near 13,220 – 250 pts. and if market traded below 13120 it confirms the bearish sentiment, shift stop loss to entry and set target exit near 13,030 pts.

Sunday, December 9, 2012

DJIA and Nasdaq 100

for the week starting 10-Dec-2012

Listening to some quiet songs (piano) while the city is covered under thick cloud. It is drizzling out there.

I prefer this weather, drizzling, not too much sun. To me, it’s the type of weather I want to sit close to my heart. Blogging, reading, listening to music, and dancing, were all of them. Just, no TV.

Last Friday, NFP result was too good, market become lively again!

Relating to NFP and some job report:

http://www.bloomberg.com/news/2012-12-07/payrolls-in-u-s-rose-146-000-in-november-jobless-rate-at-7-7-.html

http://www.businessinsider.com/nomuras-reaction-to-jobs-report-2012-12

Technical Analysis

DJIA

Friday closing: 13,155.13 pts (+81.09 pts, 0.62%)

Weekly Chart: DJIA posted another bullish candle on weekly chart, and therefore this coming week, outlook is bullish, market should continue towards next resistance 13,260 pts – 13,300 pts.

Daily Chart: Strong Support 12,930 pts

Intraday Chart (4H) market bounced off EMA50 on 4-Dec-2012 and we reckon the upward momentum to continue to 13,190 region before it comes down to test intraday support 13000 pts.

Prefer to enter long on Monday using initial shadow, buy near 13,080 pts, SL 40 pts away, Target Exit 13,200 pts or EOD.

Nasdaq 100

Friday closing: 2,978.04 pts (-11.23 pts, -0.38%)

The rest of the world is bullish, and Nasdaq 100 came down!

Apple, the stock of the largest US company fell 2.6 percent to $533.25, extending its losses for the week to 8.9 percent dragged Nasdaq 100 amid the positive job report.

Weekly Chart: neutral, market trading below strong support 2640 pts by 2 pts.

Daily Chart: bearish, if market could not break above 2650 pts but traded below 2640 pts, there is a high possibility market continue to go down. Otherwise, breaking above 2650 market shall retest swing high 2674 pts, an ideal level for a new short.

Intrady Chart:

This Monday, I reckon market to trade sideways bias up, to 2650 pts. Intraday resistance 2653 pts.

In fact, market has just create a new XAB downwave.

I am soooo into shorting, selling Nasdaq 100.

Throughout the week, my main objective is hunting for EMA50 rejection (4H chart), short with initial exit at 2630 pts, TG 1 2595 – 2600 pts.

Wish everyone another profitable trading week ahead.

Cheers

Ayumi

Listening to some quiet songs (piano) while the city is covered under thick cloud. It is drizzling out there.

I prefer this weather, drizzling, not too much sun. To me, it’s the type of weather I want to sit close to my heart. Blogging, reading, listening to music, and dancing, were all of them. Just, no TV.

Last Friday, NFP result was too good, market become lively again!

Relating to NFP and some job report:

http://www.bloomberg.com/news/2012-12-07/payrolls-in-u-s-rose-146-000-in-november-jobless-rate-at-7-7-.html

http://www.businessinsider.com/nomuras-reaction-to-jobs-report-2012-12

Technical Analysis

DJIA

Friday closing: 13,155.13 pts (+81.09 pts, 0.62%)

Weekly Chart: DJIA posted another bullish candle on weekly chart, and therefore this coming week, outlook is bullish, market should continue towards next resistance 13,260 pts – 13,300 pts.

Daily Chart: Strong Support 12,930 pts

Intraday Chart (4H) market bounced off EMA50 on 4-Dec-2012 and we reckon the upward momentum to continue to 13,190 region before it comes down to test intraday support 13000 pts.

Prefer to enter long on Monday using initial shadow, buy near 13,080 pts, SL 40 pts away, Target Exit 13,200 pts or EOD.

Nasdaq 100

Friday closing: 2,978.04 pts (-11.23 pts, -0.38%)

The rest of the world is bullish, and Nasdaq 100 came down!

Apple, the stock of the largest US company fell 2.6 percent to $533.25, extending its losses for the week to 8.9 percent dragged Nasdaq 100 amid the positive job report.

Weekly Chart: neutral, market trading below strong support 2640 pts by 2 pts.

Daily Chart: bearish, if market could not break above 2650 pts but traded below 2640 pts, there is a high possibility market continue to go down. Otherwise, breaking above 2650 market shall retest swing high 2674 pts, an ideal level for a new short.

Intrady Chart:

This Monday, I reckon market to trade sideways bias up, to 2650 pts. Intraday resistance 2653 pts.

In fact, market has just create a new XAB downwave.

I am soooo into shorting, selling Nasdaq 100.

Throughout the week, my main objective is hunting for EMA50 rejection (4H chart), short with initial exit at 2630 pts, TG 1 2595 – 2600 pts.

Wish everyone another profitable trading week ahead.

Cheers

Ayumi

Tuesday, December 4, 2012

Monday, December 3, 2012

DJIA and Nasdaq 100

for the week starting 3-Dec-2012

DJIA

Last week DJIA formed higher high, higher low - it is bullish after testing strong support 12800 - lowest 12763, and ended almost flat for the week.

It’s December already! Hopefully reports on the job market (NFP, Friday), manufacturing (PMI, Monday, Wednesday, 11pm) and consumer spending (Friday) this week may provide the market with a jump start.

Good, or bad.

Market seem bullish after testing 12800 pts., but returning to 13030 pts. also means that DJIA has recovered 50% from the fall since early Oct-12 to mid Nov-12.

Bad habit – I am waiting for a short signal.

Waiting, means no short trades for the week except NFP and consumer spending (watching).

But there are also a few clues that market may continue trading higher – first clue: market closed above EMA200. Oscillator is oversold.

May be, it will return to 13200 pts. – 2/3 from the fall since early Oct-12 to mid Nov-12.

Trade higher.

Today: Go long near 13000 pts., SL 30 pts. away, TG 13100 pts. / EOD.

Nasdaq 100

Long or short, dependent on which side of chart you sees.

I was prone bullish on Nasdaq 100 until it marked a new low 2493 last month (mid Nov-12), it takes out bullish wave, and the bearish wave is still going on.

Similar to Dow, Market recovering from the early Oct-12 to mid Nov-12 slide, and recovered 50%.

Overhead resistance 2700 pts. is strong, if only Nasdaq 100 can break above 2700, then it will have chance to trade higher to 2730 pts., otherwise, return to support 2630 pts.

DJIA

Last week DJIA formed higher high, higher low - it is bullish after testing strong support 12800 - lowest 12763, and ended almost flat for the week.

It’s December already! Hopefully reports on the job market (NFP, Friday), manufacturing (PMI, Monday, Wednesday, 11pm) and consumer spending (Friday) this week may provide the market with a jump start.

Good, or bad.

Market seem bullish after testing 12800 pts., but returning to 13030 pts. also means that DJIA has recovered 50% from the fall since early Oct-12 to mid Nov-12.

Bad habit – I am waiting for a short signal.

Waiting, means no short trades for the week except NFP and consumer spending (watching).

But there are also a few clues that market may continue trading higher – first clue: market closed above EMA200. Oscillator is oversold.

May be, it will return to 13200 pts. – 2/3 from the fall since early Oct-12 to mid Nov-12.

Trade higher.

Today: Go long near 13000 pts., SL 30 pts. away, TG 13100 pts. / EOD.

Nasdaq 100

Long or short, dependent on which side of chart you sees.

I was prone bullish on Nasdaq 100 until it marked a new low 2493 last month (mid Nov-12), it takes out bullish wave, and the bearish wave is still going on.

Similar to Dow, Market recovering from the early Oct-12 to mid Nov-12 slide, and recovered 50%.

Overhead resistance 2700 pts. is strong, if only Nasdaq 100 can break above 2700, then it will have chance to trade higher to 2730 pts., otherwise, return to support 2630 pts.

了结巧克力,感恩我的身体

Today is the 3rd day I spend with Mercedes Nieto. A Hungarian bellydancer.

my same foot, on the same dance floor, at the end of 2 days intensive.

I captured a similar picture last year... I appreciate this pair of feet, thankful because I am still dancing.

And survived the 2 days intensive workshop of 12 hours in total.

这对脚板,似曾相识。就在同一个Dance Floor,一年以后的脚板,还是完整无缺的在努力地舞者我们疯狂的、执着的快乐。

这一次,我再次尝试到——兴奋、期待、学习、背舞步、Memory full,记不到,大脑记忆体故障、当机、中virus & 发疯。

厚脸皮地说:在我的大脑系统当机以后,我一反常态地振奋,很糟糕地吵、也很乱来——我即喜欢我的后劲,又害怕操到这种程度以后的我,能不能回复正常。

感谢一年以来一同努力的朋友,我们见证了大家的努力,以及马来西亚肚皮舞的发展。

希望,明年的时候,我也一样保持初衷,原始地爱着我的身体,学习用舞蹈的语言,丝丝流露、传达歌曲的原意。

Monday, November 26, 2012

DJIA and Nasdaq 100

Good day traders, apologies! I had 2 days intensive workshop with an Argentinian dancer and was busy busy for the weekend!

My home internet is down, so I am taking my rest hour to post a quick update.

DJIA and Nasdaq 100 for week starting 26 Nov 2012

Technical Analysis

DJIA

Weekly candle: bullish

Daily Candle: bullish

Intraday: bullish

Last Thursday market formed a bullish candlestick pattern making a breakout to the upside.

Reckon market to continue bullish sentiment today to hit 13050 pts.

Aggressive Long entry with intial shadow, 34 pts from opening price (12964 pts), equivalent to 12930 pts, SL 30 pts away, TG 90 pts away or if you are patient, 13050 pts.

Nasdaq 100

Weekly candle: bullish

Daily candle: bullish

Intraday: bullish

Thanks giving, turkey… ^_^ presents and celebration.

Market almost reached our target 2640 last week, pointing to high of 2639 pts.

Market is currently trading below EMA200, which is also a long term resistance line. Unlike DJIA, Nasdaq 100 recovery is fast, and it has made a come back of more than 2/3 fibonacci retracement - I prefer to stay out.

Cheers

Ayumi

Monday, November 19, 2012

DJIA and Nasdaq 100

for the week starting 19-Nov-2012

DJIA

Last Friday, DJIA has posted a reversal candlestick pattern on daily chart, posting a low of 12470 pts.

We identify 12500 level as current support and reckon market to consolidate this week between 12500 – 12850 pts and hopefully market could retrace back to 13050 region in December before the bear take control again.

Market is doing retracement up but the major trend is still bearish, I prefer to stay out.

Nasdaq 100

Similar to Dow, market has hit 3L 2523 pts and formed new low at 2493 pts, reckon market to consolidate bias up towards 2560 pts, and hopefully return to 2600 pts before the next fall take place in December.

Nasdaq 100 is trading as 2540, Daily Trading hunt Long near support 2535 pts, TG 2560 or close EOD.

DJIA

Last Friday, DJIA has posted a reversal candlestick pattern on daily chart, posting a low of 12470 pts.

We identify 12500 level as current support and reckon market to consolidate this week between 12500 – 12850 pts and hopefully market could retrace back to 13050 region in December before the bear take control again.

Market is doing retracement up but the major trend is still bearish, I prefer to stay out.

Nasdaq 100

Similar to Dow, market has hit 3L 2523 pts and formed new low at 2493 pts, reckon market to consolidate bias up towards 2560 pts, and hopefully return to 2600 pts before the next fall take place in December.

Nasdaq 100 is trading as 2540, Daily Trading hunt Long near support 2535 pts, TG 2560 or close EOD.

Thursday, November 15, 2012

Updates on Thu 15 Nov 2012

I am going to get the song "Spring" choreographed!

These songs were from Karim Nagi latest album "Arabized", very cool crossovers.

FOMC

Minutes

Bloomberg Video

DJIA

Market shed 90 pts after FOMC meeting minutes

My long trade on Nasdaq100 has triggered SL immediately at the following hour.

Market break below previous low without much upward retracement, not even 1/3;

Forecast market to continue extension to 3L at 12,400 pts

Check DJIA daily chart:

Strong support at 12450 pts, so if we get an opportunity to short, I may exit around 12400 - 450 pts.

Nasdaq 100

Last trading at 2530, not much room to reach target, target 2523, previous support 2522.

Gold

Weekly Chart

With the bullish candlestick pattern last week, I reckon market to head up, although I am not that convinced as Gold didn't reach 50% retracement level to $1661.

Daily Chart

Gold has posted a handsome reversal when it touches EMA200, as u know I am not convinced, but if market were to continue bullish sentiments, i take 1:1 target price near $1784.

Intraday Chart

Same support were seen in 4H chart, there are a few inner wave plotted.

Gold last traded at $1725, reckon market to trade within this symmetrical triangle, breaking up or down.

breaking down to $1705, breaking up to complete 1:1 and reach $1784.

Monday, November 12, 2012

DJIA and Nasdaq 100

for week Starting 12-Nov-2012

Economic Data release: US Retail Sales Report (Nov 14), FOMC Meeting Minutes (Nov 14)

Short-term effects of super storm Sandy, longer-term fears about and consequences of "fiscal cliff" will make U.S. economy unstable, tough to predict

DJIA edged up 4.07 pts. last Friday, to 12,815.39 pts. at the close, Nasdaq 100 gained 9.29 pts. to 2904.87 at the close. For the week, DJIA fell 2.1% and Nasdaq 100 lost 2.6%.

News are about election, post election sell off, then fiscal cliff - the agreement on spending cuts and tax increases that are due to kick in early 2013. There is not election to distract us, and fiscal cliff fears, Sandy aftermath may send market lower in coming weeks.

Ever since we mentioned here that DJIA weekly chart has confirmed the bearish candlestick pattern (related post here)

Oct 1 : http://ayumi216.blogspot.com/2012/10/djia-and-nasdaq-100.html

Oct 22 : http://ayumi216.blogspot.com/2012/10/djia-and-nasdaq-100_22.html

Market has posted series of black candle on daily chart and has reached my target 12800 with a slightly longer tail on weekly chart.

Daily Chart:

Friday candlestick pattern may suggest the beginning of retracement in this bearish market.

Technically, Market shall return to 13150 pts. (also EMA20) – with the fundamental woes, we might observe the immediate resistance at 13000 (1/3 retracement level, also EMA50 in 4 hour chart).

My trading preference is to go long, at initial shadow, and close EOD.

Daily Trading setup (initial shadow : White shadow 3 pts.) entry could be around 12825 pts., SL 12775, TG 13000 or close EOD.

Nasdaq 100

Similar to Dow, we expect market to found support around 2560 pts. (2/3 Fibonacci retracement level from 3June low - 16Sep high).

Resistance 2640 pts., Strong resistance 2660 pts.

Daily Trading with initial shadow – Long 2584 SL 2579, TG 2620 or close EOD.

Monday, November 5, 2012

Gold on Week Starting 5-Nov-2012

Gold

Market has came down and testing EMA200 on Daily chart, looking at last Friday’s candle, today might be a doji candle signaling short term rebound.

Reckon market to form a doji candlestick pattern on weekly chart, and a white candle next week around $1730-1734.

This week on Gold I will be hunting Long, near $1660 levels.

Resistance : 1700, 1709 (EMA 50) if cannot break above then downward pressure shall resume, to $1618-1620 maybe?

Resistance: 1734 if market break above 1710 convincingly.

DJIA and Nasdaq 100

Forum is not available… I will resume my weekly posting when forum is accessible.

Went to Southgate, KL, on Sunday morning and danced for 3 hours learning fan veil. Flip, flip, flip! When the workshop is over, I can only see my fingers shivering - been holding a fan with 1.8 meters of silk material, flip them in the air, turn and dance.

They look graceful, and dancers need time to develop the right grace – holding the fan the right angle, holding them the right direction (forward or back of our hands), keeping them above the ground, and keep our body still.

Tired, but glad I learned this after 4 years.

DJIA and Nasdaq 100 Update for week Starting 5-Nov-2012

DJIA

Last week markets were closed Monday Tuesday marking the first two-day weather-related shutdown since 1888. Sandy the Hurricane destroy businesses, households, and critical infrastructure –might be the clue to next market direction.

US employers hired more than forecast (123k) in October 2012 – payroll expanded by 171,000 following 148,000 gain in September. Unemployment rate rose from 7.8% to 7.9%. Thomson Reuters / University of Michigan consumer sentiment index rose last month to the highest level in 5 years (since before recession).

Election next week Tuesday-Wednesday, trade or not trade?

My opinion: Fundamentals is the underlying force of market direction, technical forecast could forecast price based on historical, pattern, support, resistance and time… when in doubt, stay out.

Technical Analysis

Market settle at 13093.16 pts last Friday (-139.46 pts), posted another black doji on Weekly Chart.

(1) could be another long body black candle down.

(2) Go down to test 13000 support, rebound, and trade higher within these two weeks’ trading range capped below 13,3580 pts.

Daily Chart:

Market tested 13,000 pts last week, this is also EMA200 on Daily chart, after Friday’s black candle, we expect market to test this support again, if market came down but didn’t revisit 13000, we shall have a nice upwave. Otherwise, once it fall to 12950, all the way to 12800 pts.

4 Hour Chart:

Market is trading around EMA50 support which a rebound is likely after testing 12992 (red horizontal line).

To be precise, market should rebound before touching 12992, and it will have the potential to reverse up immediately.

However, if market break below 12992 pts, then we forecast market to fall towards 12800 level.

Personally I prefer market to form new low, but above 12992 pts and start to rebound up towards tg1 13350, then tg2 13530 pts.

Nasdaq 100

I was fortunate to take profit below 2700 before market had a big hit last Friday.

From weekly chart, market has retraced 66% from recent upwave since June 2012.

2630-2640 is a good support level if market were to perform similar to DJIA.

Strong Support 25/10/12 (2611 pts) should not be broken, and if market rebound before testing 2630 – 2640 pts, we could expect market to revisit 2700, then 2750 pts.

Lets say market break below 2640 pts, and break below 2611, we could expect support near 2585 pts.

Cheers

Ayumi

Went to Southgate, KL, on Sunday morning and danced for 3 hours learning fan veil. Flip, flip, flip! When the workshop is over, I can only see my fingers shivering - been holding a fan with 1.8 meters of silk material, flip them in the air, turn and dance.

They look graceful, and dancers need time to develop the right grace – holding the fan the right angle, holding them the right direction (forward or back of our hands), keeping them above the ground, and keep our body still.

Tired, but glad I learned this after 4 years.

DJIA and Nasdaq 100 Update for week Starting 5-Nov-2012

DJIA

Last week markets were closed Monday Tuesday marking the first two-day weather-related shutdown since 1888. Sandy the Hurricane destroy businesses, households, and critical infrastructure –might be the clue to next market direction.

US employers hired more than forecast (123k) in October 2012 – payroll expanded by 171,000 following 148,000 gain in September. Unemployment rate rose from 7.8% to 7.9%. Thomson Reuters / University of Michigan consumer sentiment index rose last month to the highest level in 5 years (since before recession).

Election next week Tuesday-Wednesday, trade or not trade?

My opinion: Fundamentals is the underlying force of market direction, technical forecast could forecast price based on historical, pattern, support, resistance and time… when in doubt, stay out.

Technical Analysis

Market settle at 13093.16 pts last Friday (-139.46 pts), posted another black doji on Weekly Chart.

(1) could be another long body black candle down.

(2) Go down to test 13000 support, rebound, and trade higher within these two weeks’ trading range capped below 13,3580 pts.

Daily Chart:

Market tested 13,000 pts last week, this is also EMA200 on Daily chart, after Friday’s black candle, we expect market to test this support again, if market came down but didn’t revisit 13000, we shall have a nice upwave. Otherwise, once it fall to 12950, all the way to 12800 pts.

4 Hour Chart:

Market is trading around EMA50 support which a rebound is likely after testing 12992 (red horizontal line).

To be precise, market should rebound before touching 12992, and it will have the potential to reverse up immediately.

However, if market break below 12992 pts, then we forecast market to fall towards 12800 level.

Personally I prefer market to form new low, but above 12992 pts and start to rebound up towards tg1 13350, then tg2 13530 pts.

Nasdaq 100

I was fortunate to take profit below 2700 before market had a big hit last Friday.

From weekly chart, market has retraced 66% from recent upwave since June 2012.

2630-2640 is a good support level if market were to perform similar to DJIA.

Strong Support 25/10/12 (2611 pts) should not be broken, and if market rebound before testing 2630 – 2640 pts, we could expect market to revisit 2700, then 2750 pts.

Lets say market break below 2640 pts, and break below 2611, we could expect support near 2585 pts.

Cheers

Ayumi

Sunday, October 28, 2012

Weekly Forecast (FX) + Gold

GBP/USD

Daily range : 80 pips

Current: 1.6090

Daily chart: Trading in a downward channel, ding dong up and down towards 1.5850 (EMA200) in 2 weeks time.

Intraday chart: bearish, reckon to return to equilibrium :: shall slide from current 1.6090 to 1.6045, hopefully can reach 1.6020 before posing higher.

Stay out.

USD/JPY

Daily Range: 45 pips

The central bank is expected to cut its growth and price projections at the October 30 policy meeting.

Market is led by fundamental developments - weak external demand, strong yen… how would the next stimulus package help with USD/JPY? Stay close to news and I prefer to stay out.

EUR/USD

Daily Range: 70 pips

Weekly chart: Sideways, contracting trading range, awaiting breakout.

Daily chart: current support risen up to 1.2890, resistance 1.2990. Strong support 1.2800, Strong Resistance 1.3090.

Intraday (4H) Chart: market shall continue trading in this flag pattern until Thursday / Friday.

Neutral. No trade.

XAU/USD

Daily Range: $16

Weekly Chart: Bearish, although with a star candlestick pattern, we need a confirmation if market is going to reverse up and resume up trend.

Personal bias:

We at Ayumi the Novice Trader reckon market to continue trending down from current price $1712 towards $1660, that is -$50.

Daily Chart:

Gold has posted a strong gain last Friday, from low $1700 to $1718 – and this bullish sentiment shall take a breather, retrace to $1709, and challenge $1720 again on Monday.

Trading Plan:

I will hunt for short instead of Long at support…

However, for aggressive trading : I would place a Long trade on Monday near $1709, close EOD or near resistance.

Main objective for the week would be hunting short near resistance $1715-20, target exit 1700.

chart explains far better than words:

Cheers

Ayumi

DJIA and Nasdaq 100

Dim sum breakfast with a group of fun person, help to hang a photo frame on the wall in a friend’s living room (I am not the one hanging, but I do marking and measurements), and laze the whole afternoon – made instant noodles, read news, ate chocolates, took some fresh milk, read magazine, and watch some Taiwanese drama…

Rain was heavy and I can see the rain pour from one side of the city, to the other side.

Having a Sunday like this is really cool, it has been like… 2-3 months I don’t get to rest this way, appreciate.

DJIA and Nasdaq 100 Update for week Starting 29-Oct-2012

DJIA

Market has post another black candle on weekly chart after last week’s confirmation.

While the earnings report is still on the way (more than half has reported their earnings) but I think the economic data which is due to release this week, NFP, is going to be the focus of all traders and investors.

After having the QE3 in force, election, can US create more jobs and reduces jobless rate as per the market forecast?

Crucial Friday.

Strong Support: 12950 pts.

If, DJIA break below this strong support, then it shall head down to TG1 12750. Then 12500 pts.

However, I believe market to sustain above 12950 in this coming week.

Intraday Chart (4H)

Turning Long near Friday low 13004 pts. is preferable - SL 12950 pts.

Rebound shall bring DJIA back to 13200 pts., then trade sideway bias up to test 13300 pts. (last week opening).

Yes, I am bias long in the middle of this bearish trend. Trade with caution and lets aim for another short after market face rejection around 13300 pts.

Intraday trade for Dow: Long @ 13050 – 13070, SL 13000, TG 13200.

Nasdaq 100

Bearish

Weekly: Bearish

Daily: Bearish – meeting EMA200 support, leading to short term consolidation.

4 Hour: market should rebound in coming week (similar to Dow), and I do hope the rebound could at least bring Nasdaq 100 back to 2698 – 2700 pts.

In coming month (November), lets say market rebounded to 2700 and face hard resistance, we reckon another wave of correction, sending market down south to 2570 pts.

Compare to Dow, Nasdaq 100 is more bearish and I would prefer to Long Dow, than to Long Nasdaq 100.

Cheers

Ayumi

Thursday, October 25, 2012

DJIA an Nasdaq 100

On Thu 25-Oct-2012

Nasdaq 100

I feel so like entering long... but not yet.

clue within 30 minutes chart

Trend: bearish, with momentum, strong.

approaching support 2660 but I think should trade lower soon.

2nd clue, 4 hr chart:

may be it still need a little bit of time before we accumulate enough power to reverse.

Lets spot a strong support level from daily chart:

2640 pts, Thursday (today).

DJIA

bearish, consolidation, challenging lower.

likely to hit 13050 and test below 13000 soon.

However, I don't suggest trading long unless we see rejection around 12950.

Those prefer going short, park short order near 13150-177 pts, TG 13000 (less favour).

Cheers

Ayumi

Nasdaq 100

I feel so like entering long... but not yet.

clue within 30 minutes chart

Trend: bearish, with momentum, strong.

approaching support 2660 but I think should trade lower soon.

2nd clue, 4 hr chart:

may be it still need a little bit of time before we accumulate enough power to reverse.

Lets spot a strong support level from daily chart:

2640 pts, Thursday (today).

DJIA

bearish, consolidation, challenging lower.

likely to hit 13050 and test below 13000 soon.

However, I don't suggest trading long unless we see rejection around 12950.

Those prefer going short, park short order near 13150-177 pts, TG 13000 (less favour).

Cheers

Ayumi

Monday, October 22, 2012

DJIA and Nasdaq 100

For the week starting 22-Oct-2012

World stocks, Commodity and Crude Oil fell on Friday upon fresh global economic concerns, lack of progress on Spanish bailout request.

Gold fell from $1742 region to $1720.80, $20 (more than 1 percent) – the biggest one-day slide in more than 3 months.

DJIA fell from 13550 region to 13343.51 pts., -205.43 pts. (more than 1.5 percent) – erased most of the week’s gains as the earnings from large multinationals underscored.

CBOE Volatility Index (VIX) jumped 13.5 percent to 17.06, highest level since 5th Sep 2012.

Technical forecast

DJIA

Weekly candlestick pattern:

bearish, with confirmation.

Daily candlestick pattern:

bearish

Intraday:

market is approaching the critical support 13300-350 pts., if market closed below 13300, then we shall see the bearish sentiment continue.

After Friday (19/10/2012) plunge, stochastic oscillator, is showing strong oversold and market is likely to come up, take a breath above red blue sea, then continue sinking towards 13200 pts.

This short term up move, might face resistance at 13400, or 13450 pts.

Market is unlikely to revisit 13500 level anymore unless there’re rumors to bring it up.

My trading opinion:

Hunt Short 13400. SL 13450. TG 13200.

Cheers

Ayumi

Wednesday, October 17, 2012

Gold on Wed 17-Oct-2012

Last few cycle spent 7 candles to rebound and cross $4-$5 above EMA50, and fall.

this round it took 10 candles, and how long would it takes to finally decide to break above EMA50 before coming down again?

Or it would never happen?

I will wait another 4 candles (4 x 4 hours = 16 hours) for retracement, unless market shows a strong reversal pattern in 30 mins or 60 mins chart.

Still, patience.

You are at the same time given more courage

I am going to attend the manager’s conference tomorrow and was reading about Gregory Burns this morning; he is one of the guest speakers of this event.

Things happened these few days – cd player doesn’t work, lost my phone, travelled in and out of the country, lack of sleep, market rebounded but I can’t join the trade although I believe 13300 is the critical support point for DJIA… couple of events has added emotional burden on me, I feel miserable.

I am not good at releasing my emotions onto people, I couldn’t express myself as I think it is unfair to the audience… best thing I could do to myself, is to lock myself in a dark room, recollect the miserable events, and sleep with it. When I have enough of all, I blog.

So, this blog post is a release of my emotions, so I could stand tall and walk again.

I read from Gregory Burns:

This line inspired me, counting the things I lack – is enough. I have been counting them since 12/10/2012... And I think it’s time to let go.

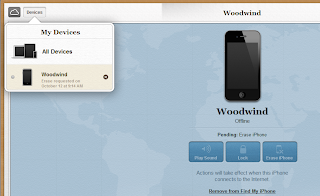

Goodbye to Woodwind, my iPhone4.

Wait for another chance, another week to trade the market.

From 13,300 pts. to 13,550 pts. is 250 pts., Dow30, I miss you once, but I know,

you go and you are bringing your friends and relatives, bring me multiple of 250 pts. of real profit.

Patience, Perseverance

Ayumi

Things happened these few days – cd player doesn’t work, lost my phone, travelled in and out of the country, lack of sleep, market rebounded but I can’t join the trade although I believe 13300 is the critical support point for DJIA… couple of events has added emotional burden on me, I feel miserable.

I am not good at releasing my emotions onto people, I couldn’t express myself as I think it is unfair to the audience… best thing I could do to myself, is to lock myself in a dark room, recollect the miserable events, and sleep with it. When I have enough of all, I blog.

So, this blog post is a release of my emotions, so I could stand tall and walk again.

I read from Gregory Burns:

“Everyone is imperfect. You might be born into a disabled condition, but you are at the same time given more courage. We should look at what we own ant not things we lack.”

This line inspired me, counting the things I lack – is enough. I have been counting them since 12/10/2012... And I think it’s time to let go.

Goodbye to Woodwind, my iPhone4.

Wait for another chance, another week to trade the market.

From 13,300 pts. to 13,550 pts. is 250 pts., Dow30, I miss you once, but I know,

you go and you are bringing your friends and relatives, bring me multiple of 250 pts. of real profit.

Patience, Perseverance

Ayumi

Monday, October 15, 2012

DJIA and Nasdaq 100

Lost a couple of trades, lost my phone last Friday, and confirms that my cd player is broken before weekend.

It was a fun filled weekend, I had a short trip south to Singapore, love people, love Shiraz, Clark Quay, love Shang Palace 香宫. Love food, love friends, love dancing.

Had too much of good food since last Monday.

Blessed tummy, blessed taste buds. Thanks!

I reached home by 3:30 am (about 2 hours ago), took a quick bath and I think it is a good idea to review for this coming week, before sunrise. So, here we go.

For the week starting 15-Oct-2012

Reporting season is heating up, with only 6% of S&P 500 companies having reported, 59% of companies have topped estimates – less than the average beat rate of 67% for the past 4 quarters according to Thomson Reuters data.

Half of companies have beaten on revenue, while a quarter missed profit forecasts.

Trading could be volatile for Nasdaq 100, I have trigged SL and I prefer staying out.

This week we will look ahead to economic data on retail sales, consumer price index (CPI) for September, and existing home sales.

Technical Forecast

DJIA has a losing week and it is hovering between 13350 and 13300, as you know I was hunting for long, and I have entered two long orders, both has been stopped out.

Last week was also a losing week for me.

With the earning reports coming up, I believe this week to be another volatile week.

From the weekly candle, it has confirmed a bearish momentum, but daily chart is showing support – we mentioned the crucial support level 13350 for past 2-3 weeks, and DJIA is already trading around crucial support 13350, breaking below 13300 would confirm bearish trend for next 2 – 3 weeks.

Once 13300 strong support was broken we expect DJIA return to 13000 (the lowest level in early September).

Stay out - unless market shows strength and renounce at 13300 pts., it shall then return to 13500 resistance.

Or else market break below 13300, it will plunge all the way to 13000 pts.

Cheers, I am going to hit the bed,

Ayumi

Sunday, October 7, 2012

DJIA and Nasdaq 100

For the week starting 8-Oct-2012

We mentioned 13350 pts. is the critical level for Dow, closing below 13350 pts. shall confirm bearish sentiment.

Last Monday 1/10/12: DJIA opens at 13447.80 pts., wen to the lowest point 13,425.30 on Tuesday 2/10 and close at 13610.15 pts. on Friday.

Market didn’t turn bearish, and didn’t turn bullish yet –previous easing has push up the stocks and commodity prices.

http://www.cnbc.com/id/49274085

Year 2008, when Fed announced QE in late November, market drives up by 400 pts. in a day and then spurred a month-long rally.

(buying $600 billion MBS)

Year 2010, Fed announces QE2, in November, 3/4 Nov 2010, market drives up 217 pts. in a day, continues to move up higher but tumbled 400 pts. in the following week.

(buying $600 billion Treasury Shares)

Year 2012, Fed announces QE3 in September, 13 Sep 2012, market drives up by 185 pts. in a day

(buying $40 billion of MBS per month, with no limit, open ended = no ending date)

Quantitative Easing (QE) Infinity (rumors called it) has bring market up, but capped below 13700 pts.

What we might want to know is:

1. Whether market has reached the top and

2. Whether market would tumble as investors digest this information

Its hard to tell as the election is on its way and I suspect market shall continue to trade sideways above 13350, testing 13700.

Technical Forecast

I use weekly chart to identify major support resistance and the same is plotted into daily chart.

Daily Chart: Market is supported above 13350, and if market tumbled and closed below 13300, it shall plunge to 13050 pts.

Elections, elections, elections, market is still in a major up trend, and lets say DJIA manage to break up above this overhead resistance level 13700, then it is likely to shoot up to 14000.

It shall take time, but generally we have to be patient to wait for the breakup / breakdown. Market is trading sideways as profit taking is happening.

4 Hour Chart: Bull – Bear Tug of War, market was trading below EMA50 last week of Sep 12, and stayed above EMA50 last week.

We suspect the sideways movement to continue and stay patience for the next big moves.

However, for intraday trade, we favour picking Long near EMA50 (4H) 13500 pts. SL 13450 TG 13650 pts.

Cheers

Ayumi

We mentioned 13350 pts. is the critical level for Dow, closing below 13350 pts. shall confirm bearish sentiment.

Last Monday 1/10/12: DJIA opens at 13447.80 pts., wen to the lowest point 13,425.30 on Tuesday 2/10 and close at 13610.15 pts. on Friday.

Market didn’t turn bearish, and didn’t turn bullish yet –previous easing has push up the stocks and commodity prices.

http://www.cnbc.com/id/49274085

Year 2008, when Fed announced QE in late November, market drives up by 400 pts. in a day and then spurred a month-long rally.

(buying $600 billion MBS)

Year 2010, Fed announces QE2, in November, 3/4 Nov 2010, market drives up 217 pts. in a day, continues to move up higher but tumbled 400 pts. in the following week.

(buying $600 billion Treasury Shares)

Year 2012, Fed announces QE3 in September, 13 Sep 2012, market drives up by 185 pts. in a day

(buying $40 billion of MBS per month, with no limit, open ended = no ending date)

Quantitative Easing (QE) Infinity (rumors called it) has bring market up, but capped below 13700 pts.

What we might want to know is:

1. Whether market has reached the top and

2. Whether market would tumble as investors digest this information

Its hard to tell as the election is on its way and I suspect market shall continue to trade sideways above 13350, testing 13700.

Technical Forecast

I use weekly chart to identify major support resistance and the same is plotted into daily chart.

Daily Chart: Market is supported above 13350, and if market tumbled and closed below 13300, it shall plunge to 13050 pts.

Elections, elections, elections, market is still in a major up trend, and lets say DJIA manage to break up above this overhead resistance level 13700, then it is likely to shoot up to 14000.

It shall take time, but generally we have to be patient to wait for the breakup / breakdown. Market is trading sideways as profit taking is happening.

4 Hour Chart: Bull – Bear Tug of War, market was trading below EMA50 last week of Sep 12, and stayed above EMA50 last week.

We suspect the sideways movement to continue and stay patience for the next big moves.

However, for intraday trade, we favour picking Long near EMA50 (4H) 13500 pts. SL 13450 TG 13650 pts.

Cheers

Ayumi

Monday, October 1, 2012

DJIA and Nasdaq 100

for the week starting 1-Oct-2012

Concerns over Euro zone sovereign debt issues dragged Wall Street market down last week.

Stocks ended lower but posted the best gain since Quarter 3 since 2010.

DJIA slipped 48.84 pts last Friday to close at 13,437.13 pts (-0.36%).

While September is historically the worst performing months for stocks, DJIA rallied 2.7% this month, logging the third largest gain in 2012.

For the quarter DJIA posted robust gains of 4.32%.

Generally traders are cautious about this quarter (October 1st is here!) – with the elections and fiscal cliff coming up, and we expect some profit taking to happen during next couple of months.

Technical Analysis

Concerns over Euro zone sovereign debt issues dragged Wall Street market down last week.

Stocks ended lower but posted the best gain since Quarter 3 since 2010.

DJIA slipped 48.84 pts last Friday to close at 13,437.13 pts (-0.36%).

While September is historically the worst performing months for stocks, DJIA rallied 2.7% this month, logging the third largest gain in 2012.

For the quarter DJIA posted robust gains of 4.32%.

Generally traders are cautious about this quarter (October 1st is here!) – with the elections and fiscal cliff coming up, and we expect some profit taking to happen during next couple of months.

Technical Analysis

Looking at the weekly chart we might observed that DJIA has posted a bearish candlestick pattern, and DJIA is trading at a crucial level – breaking below 13350 pts shall confirm the bearish sentiment in daily chart which sets the new trend for coming 2 weeks.

4 Hour chart has signals a bearish sentiments and market is currently resisted below 13500 pts (EMA50, 4H), Support 13350 pts.

We suggest to stay out or to short when market try to pierce above 13500 pts but failed.

Thursday, September 27, 2012

Transaction

Gold on 27 Sep 2012

4H chart

Green line is EMA50 which is the guide line i normally use to identify support/ resistance.

Last done $1756 and it seems market shifted from bullish to correction phase.

This green line which hover around $1760 has turned from support to resistance.

Above is gold 1H chart and u might identify the similar pattern - market is capped below 1760.

I hv entered a short at market ($1756). Looking forward to the south train below 1740.

4H chart

Green line is EMA50 which is the guide line i normally use to identify support/ resistance.

Last done $1756 and it seems market shifted from bullish to correction phase.

This green line which hover around $1760 has turned from support to resistance.

Above is gold 1H chart and u might identify the similar pattern - market is capped below 1760.

I hv entered a short at market ($1756). Looking forward to the south train below 1740.

Tuesday, September 25, 2012

Gold on Tue 25 Sep 2012

It was wierd, I entered at market to long Gold at $1757.73 (market order, instant execution) and I also created a pending order to long at $1755, but market didn't come down, and started to trade upwards.

Market was choppy for the past 2 weeks, but yesterday it was a smooth one...

Current support is $1755 since market has resumed upward testing this low for 3rd time in a week.

I am looking forward to Gold breaking the top resistance 1786 and trade towards March high $1790 and then August 2011 high $1800.

But, if a retracement were to happen, it could bring Gold down to $1715, then $1690.

I don't wish to see Gold testing strong support $1675 but this would be the last defence for uptrend.

In summary:

TG2: 1800

TG1: 1790

Daily Target: 1786

Current Support 1755

S1: 1715

S2: 1690

S3: 1675

Market was choppy for the past 2 weeks, but yesterday it was a smooth one...

Current support is $1755 since market has resumed upward testing this low for 3rd time in a week.

I am looking forward to Gold breaking the top resistance 1786 and trade towards March high $1790 and then August 2011 high $1800.

But, if a retracement were to happen, it could bring Gold down to $1715, then $1690.

I don't wish to see Gold testing strong support $1675 but this would be the last defence for uptrend.

In summary:

TG2: 1800

TG1: 1790

Daily Target: 1786

Current Support 1755

S1: 1715

S2: 1690

S3: 1675

Sunday, September 23, 2012

DJIA and Nasdaq 100

For the week starting 24 Sep 2012

DJIA

Last week, Apple announced iPhone 5, and the share price closing up above $700 per share.

Poor chinese manufacturing data sync with slowdown in US and UK.

We are moving closer to the quarter end and we expect traders’ to wrap up their trades while moving into a rocky / choppy 4th quarter.

With elections coming up, and a few economic data such as: consumer confidence,

pending home sales, fed balance sheet & money supply (read: CNBC link) we expect market to trade sideways in the coming week.

Stay out.

Resistance: 13660

Current support: 13500

Support: 13370

Nasdaq 100

Nasadq 100 continue moving north with a slower momentum and showing support at 2845 pts.

Expect market to trade sideways bias up.

Support: 2845 pts

Resistance: 2880 pts

Like the channel in the chart below (NASDAQ 100 4H).

DJIA

Last week, Apple announced iPhone 5, and the share price closing up above $700 per share.

Poor chinese manufacturing data sync with slowdown in US and UK.

We are moving closer to the quarter end and we expect traders’ to wrap up their trades while moving into a rocky / choppy 4th quarter.

With elections coming up, and a few economic data such as: consumer confidence,

pending home sales, fed balance sheet & money supply (read: CNBC link) we expect market to trade sideways in the coming week.

Stay out.

Resistance: 13660

Current support: 13500

Support: 13370

Nasdaq 100

Nasadq 100 continue moving north with a slower momentum and showing support at 2845 pts.

Expect market to trade sideways bias up.

Support: 2845 pts

Resistance: 2880 pts

Like the channel in the chart below (NASDAQ 100 4H).

Saturday, September 22, 2012

Work out, workshops

A dumbbell, a yoga mat, get ur health in shape.

Coming months will be workshops, workout, and more workout!

- Posted using BlogPress from my iPhone

Coming months will be workshops, workout, and more workout!

- Posted using BlogPress from my iPhone

Friday, September 21, 2012

Kind and Considerate

the vibes...

there are character you like, and some character you don't..

when it comes to those you are less favour of, would you reject? Would you send the negative vibes?

I did, to the same bloody person who (have no choice) but come in right before 6pm and give me tasks to do.

Yeah, I send the negative vibes -- and I hope it doesn't bounce back to me.

Good read from Ralph Marston:

The Greatest Success link

there are character you like, and some character you don't..

when it comes to those you are less favour of, would you reject? Would you send the negative vibes?

I did, to the same bloody person who (have no choice) but come in right before 6pm and give me tasks to do.

Yeah, I send the negative vibes -- and I hope it doesn't bounce back to me.

Good read from Ralph Marston:

The Greatest Success link

You don’t have to be famous to be important. You don’t have to be a celebrity to be successful.

You don’t have to live in opulent luxury to be rich. You don’t have to be irresponsible to be free.

You don’t have to be outrageous to be creative. You don’t have to be abusive to be impressive.

You can be quietly humble and still be amazingly effective. You can be kind and considerate and still have great influence.

Just because people don’t fall at your feet and worship you, doesn’t mean you are a failure. Quiet success is just as sweet as loud, flamboyant success, and usually much more real.

Monday, September 17, 2012

DJIA and Nasdaq 100

for the week starting 17 Sep 2012

On Thursday, Fedebral Reserve Chairman Ben Bernanke announced QE3 policy, to expand its bond purchase program of mortgage bond at USD40 billion per month, target to boost housing growth and job creation. No limit has been mentioned.

Stocks, and commodities (look at Gold!) rose last Thursday and Friday.

DJIA

In line with ECB plan to buy government bonds of struggling euro zone countries and US Federal Reserves monthly USD40 billion Bond Purchase Program has bring Dow to the highest closing level in nearly 5 years.

After this mid-week euphoria, a more sober period for market may be coming as investors and traders digest what the stimulus means in the long term.

US elections in November, tax and spending cuts, corporate earnings, if the unerlying economic data stays the same, we are going to see the market drop a bit, and trading sideways until election.

Technical Forecast:

Market to trade sideways digesting the mid-week hype.

Market has hit 2L target 13578 pts and technically it should be trading sideways.

Resistance - current high: 13650 pts

Immediate support: 13505 pts

Strong Support: 13350 pts

Sideways trading bias down towards 1/3 @ 13250-300 for the rally since July 2012.

Nasdaq 100

Nasdaq 100 has marched up to 12 years highs.

Bullish and immediate support at 2818 pts.

Strong support 2803 pts.

While we expect market to digest the stimulus announcements, market shall trade sideways in a flag pattern before resuming the up trend.

Stay out for the week while observe for trading opportunities around these support levels.

On Thursday, Fedebral Reserve Chairman Ben Bernanke announced QE3 policy, to expand its bond purchase program of mortgage bond at USD40 billion per month, target to boost housing growth and job creation. No limit has been mentioned.

Stocks, and commodities (look at Gold!) rose last Thursday and Friday.

DJIA

In line with ECB plan to buy government bonds of struggling euro zone countries and US Federal Reserves monthly USD40 billion Bond Purchase Program has bring Dow to the highest closing level in nearly 5 years.

After this mid-week euphoria, a more sober period for market may be coming as investors and traders digest what the stimulus means in the long term.

US elections in November, tax and spending cuts, corporate earnings, if the unerlying economic data stays the same, we are going to see the market drop a bit, and trading sideways until election.

Technical Forecast:

Market to trade sideways digesting the mid-week hype.

Market has hit 2L target 13578 pts and technically it should be trading sideways.

Resistance - current high: 13650 pts

Immediate support: 13505 pts

Strong Support: 13350 pts

Sideways trading bias down towards 1/3 @ 13250-300 for the rally since July 2012.

Nasdaq 100

Nasdaq 100 has marched up to 12 years highs.

Bullish and immediate support at 2818 pts.

Strong support 2803 pts.

While we expect market to digest the stimulus announcements, market shall trade sideways in a flag pattern before resuming the up trend.

Stay out for the week while observe for trading opportunities around these support levels.

Friday, September 14, 2012

Nano Mist and Yummy Chinese Food

I am not going to talk much about market.

QE3 is announced.

Gold price rallied $100 in a week, stocks new high...

====

I visit Car's International yesterday intend to do car wash.

And here is a successful upsell.

I am considering of the windscreen treatment.

He upsell me front windscreen with rear windscreen treatment.

worth RM235 (Ringgit Malaysia) equivalent to $95 SGD or $77 USD.

From Car wash which is is only RM10 / $4 SGD / $3.3 USD

Or a Front windscreen GP Coat Treatment which costs RM135 / $54 SGD / $44 USD.

I ended up doing GP Coat treatment (Front & Rear windscreen) + Polish + Wax + Nano Mist for my white color princess.

When I collect my car, she is true beaty with dashboard shine, tyre shine, I am satisfied.

Smells good too!

While I am driving home, I am hoping for rain, to test the windscreen treatment. And it rains at night before I hit the dance floor. The rain stopped when I finish dancing, teaching, I splash some plain water and wipe it dry.

It was a good day, and I am happy because everything go as planned except the sucessful upsell hahaha

=====

At night I had a bad dream, someone came into my car, and taking some strong smell chinese food, the smell from the food is good, but it is not good if it stays in the car, and stinks!

And in my dream, I still trying to hold my temper while telling this nice guy: "take laaa, take the food in the car, its alright....." but my heart is torn into pieces because my princess is so clean!!!!

I am so fake!

QE3 is announced.

Gold price rallied $100 in a week, stocks new high...

====

I visit Car's International yesterday intend to do car wash.

And here is a successful upsell.

I am considering of the windscreen treatment.

He upsell me front windscreen with rear windscreen treatment.

worth RM235 (Ringgit Malaysia) equivalent to $95 SGD or $77 USD.

From Car wash which is is only RM10 / $4 SGD / $3.3 USD

Or a Front windscreen GP Coat Treatment which costs RM135 / $54 SGD / $44 USD.

I ended up doing GP Coat treatment (Front & Rear windscreen) + Polish + Wax + Nano Mist for my white color princess.

When I collect my car, she is true beaty with dashboard shine, tyre shine, I am satisfied.

Smells good too!

While I am driving home, I am hoping for rain, to test the windscreen treatment. And it rains at night before I hit the dance floor. The rain stopped when I finish dancing, teaching, I splash some plain water and wipe it dry.

It was a good day, and I am happy because everything go as planned except the sucessful upsell hahaha

=====

At night I had a bad dream, someone came into my car, and taking some strong smell chinese food, the smell from the food is good, but it is not good if it stays in the car, and stinks!

And in my dream, I still trying to hold my temper while telling this nice guy: "take laaa, take the food in the car, its alright....." but my heart is torn into pieces because my princess is so clean!!!!

I am so fake!

Sunday, September 9, 2012

DJIA and Nasdaq 100

This week on Bloomberg Radio, on TV, I have seen the speech by Barack Obama, Michelle Obama and election is so so hot!

Might be interesting to read about this:

Forex Flash: Time to stop worrying about the EUR and to start worrying about the USD

There are many news, and expectation on QE, is QE3 possible?

many would have hoped for QE3, and does US really has capacity to print more and flush their currency value down?

If we look into USD Index, it has traded sharply lower last Friday - closed below 200 days EMA @ 80.16 for the first time since Oct 2011.

Since QE is not on the table, and whether Fed is going to give the fix or not is unclear, I reckon EMA200 to give support, and I expect USD Index to rebound next 2-3 days and return to 80.80 region.

DJIA

It has turned from bearish to bullish without touching 12950, although initially we at Ayumi the Novice trader thinks that it should fall!

However, DJIA still capped below 13350 pts, and we are unsure of the next direction.

Check the intraday chart below:

DJIA 4 Hours Chart:

Broke up the channel and traded the similar range up, but still capped below resistance.

both 30 mins & 1 hour chart didn't show oversold nor tendency to turn down from current momentum, and neither giving clue of the next direction.

I prefer to stay out and observe unless intraday 30 mins / 1 hour chart has approached 13350 pts, resisted down, or breakup this resistance.

Till then I have no position but watching other instruments like Gold and CL or trading the USD Index till mid week after the adjustment has completed.

Nasdaq 100

It came out on the headline that Nasdaq 100 has ended highest since 2000.

Google it.

Bullish momentum.

Can only trade with initial shadow, not sure where the bullish momentum will stop.

Initial shadow is 6 pts, day range is 30 pts.

If you have traded the Nasdaq 100, you know it is very rare chance for traders to get in at initial shadow if the day is set to fly... repeat: it is very hard to get in, but once u are there in the right move, it is like an unlimited fortune, happy hunting.

Cheers

Ayumi

Might be interesting to read about this:

Forex Flash: Time to stop worrying about the EUR and to start worrying about the USD

There are many news, and expectation on QE, is QE3 possible?

many would have hoped for QE3, and does US really has capacity to print more and flush their currency value down?

If we look into USD Index, it has traded sharply lower last Friday - closed below 200 days EMA @ 80.16 for the first time since Oct 2011.

Since QE is not on the table, and whether Fed is going to give the fix or not is unclear, I reckon EMA200 to give support, and I expect USD Index to rebound next 2-3 days and return to 80.80 region.

DJIA

It has turned from bearish to bullish without touching 12950, although initially we at Ayumi the Novice trader thinks that it should fall!

However, DJIA still capped below 13350 pts, and we are unsure of the next direction.

Check the intraday chart below:

DJIA 4 Hours Chart:

Broke up the channel and traded the similar range up, but still capped below resistance.

both 30 mins & 1 hour chart didn't show oversold nor tendency to turn down from current momentum, and neither giving clue of the next direction.

I prefer to stay out and observe unless intraday 30 mins / 1 hour chart has approached 13350 pts, resisted down, or breakup this resistance.

Till then I have no position but watching other instruments like Gold and CL or trading the USD Index till mid week after the adjustment has completed.

Nasdaq 100

It came out on the headline that Nasdaq 100 has ended highest since 2000.

Google it.

Bullish momentum.

Can only trade with initial shadow, not sure where the bullish momentum will stop.

Initial shadow is 6 pts, day range is 30 pts.

If you have traded the Nasdaq 100, you know it is very rare chance for traders to get in at initial shadow if the day is set to fly... repeat: it is very hard to get in, but once u are there in the right move, it is like an unlimited fortune, happy hunting.

Cheers

Ayumi

Saturday, September 8, 2012

Wednesday, September 5, 2012

Gold on Wed 5-Sep-2012

well, it is one day after labour day.

Gold forecast for the week starting 4th Sep 2012

Technical Forecast

Gold [XAU/USD] Weekly Chart

as you can see, Gold price has break above the flag pattern, and its early...

refer to my previous post I Like About Gold - Gold forecast end August.

Gold has break up above 1670 and confirmed the bullish trend, though, it is early, I am kind of surprised, and still in disbelieve. But I accept the fact that it is Bullish.

Gold Daily Chart (above)

There are 3 indications supporting the bullish view.

1. Short term bullish sentiment (1)

2. Mid term bullish sentiment (2)

3. Breaking above weekly resistance line

The bullish sentiment shall last 3-4 weeks upon this confirmation.

As previous week correction didn't come down to 50%, so I reckon market to hit another leg up to $1720 before a technical correction could happen.

If it does reached $1720 and started to correct, expect market to hold at Strong support $1675.

so.... initiate Long.

Initial shadow $5

Couldn't trade short now... although I am trained to trade reversals... [reminding myself]

Cheers

Ayumi

Gold forecast for the week starting 4th Sep 2012

Technical Forecast

Gold [XAU/USD] Weekly Chart

as you can see, Gold price has break above the flag pattern, and its early...

refer to my previous post I Like About Gold - Gold forecast end August.

Gold has break up above 1670 and confirmed the bullish trend, though, it is early, I am kind of surprised, and still in disbelieve. But I accept the fact that it is Bullish.

Gold Daily Chart (above)

There are 3 indications supporting the bullish view.

1. Short term bullish sentiment (1)

2. Mid term bullish sentiment (2)

3. Breaking above weekly resistance line

The bullish sentiment shall last 3-4 weeks upon this confirmation.

As previous week correction didn't come down to 50%, so I reckon market to hit another leg up to $1720 before a technical correction could happen.

If it does reached $1720 and started to correct, expect market to hold at Strong support $1675.

so.... initiate Long.

Initial shadow $5

Couldn't trade short now... although I am trained to trade reversals... [reminding myself]

Cheers

Ayumi

Subscribe to:

Posts (Atom)